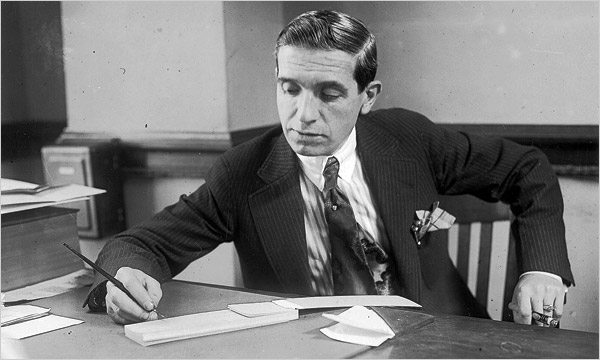

Charles Ponzi was a charismatic, well-liked man.

The DAO is under pressure to engage in practices that are (1) ill-informed, (2) incredibly risky, and (3) tantamount to a "naturally-arising Ponzi."

Case in point is the latest call for The DAO to Perform Arbitrage by Buying Its Own Tokens, and follow on posts that characterize this as a "riskless" investment. This is a uniquely misguided idea, part speculation, part Ponzi, and altogether reckless. Let me describe why.

If you don't know how The DAO works: it's a crowd-funded investment fund. You buy into The DAO with ether (a cryptocurrency), and get "DAO tokens" in return. DAO tokens are essentially shares in a computer-controlled fund. The DAO then invests your ether into worthy projects, selected by crowd voting. As these projects pay off dividends, you are supposed to make money as the crowd picks winners with its infinite wisdom, or lose money if the crowd ended up investing in turkeys.

You can take out your money at any time by selling your DAO tokens at the equivalent of a regular commodity market. Alternatively, you can convert your DAO tokens to ether through a process known as "splitting." The split process takes a minimum of 48 days, and provides a fixed rate payoff: 1 DAO token leads to 1 ether, guaranteed [1].

The funny thing is that the current market price for 1 DAO token is 0.94 ether. So, you can pay 0.94 ether right now, buy a DAO token, initiate a split, wait 48 days, and you'll have 1.0 ether in your hands, for a guaranteed 6% gain.

This seeming difference between the current price of a DAO token, and its value in ether 48 days from now, is the source of a lot of confusion for some.

This post explains what some have described as a paradox; namely, why the price of a DAO token is lower than 1.0 ether even though a DAO token entitles you to 1.0 ether in the future, why it's a mistake to call this an "arbitrage opportunity," and why The DAO buying its own tokens is tantamount to currency speculation and possibly a Ponzi.

While we showed that the voting process at the heart of The DAO is biased, I'll assume for this discussion that these flaws are magically fixed. The analysis below is independent of the flaws we found.

The masses actually love Ponzis, and will create one given the slightest pretense.

The DAO is a complicated financial instrument that, when it comes to converting it to ether, acts like a time-locked asset. It enables the holder to pay for 1.0 ether now, at a discount of 0.94 ether, and to have that 1.0 ether delivered 48 days from now. If the price of ether is $14.15 today, then $13.33 ($14.15 * 0.94) allows me to buy 1.0 ether through The DAO, as long as I am willing to wait for 48 days.

That sounds like a huge win to the uninitiated: 6% compounded interest every 48 days yields 50% annual interest!

The only caveat here is that these dreams are denominated in ether. Because almost everything you might actually want to buy today is denominated in dollars, we need to convert back to fiat.

So how much will that 1.0 ether be worth 48 days from now? Recall that the price of ether in dollar terms fluctuates, sometimes wildly. It can, and does, go down.

There is no telling how much 1 ether is going to be worth 48 days from now. It may well be lower than today's price. A lot lower.

The reason why The DAO tokens are cheaper than 1.0 ether is because of this uncertainty.

On the flipside, the price of a DAO token is capped at 1.0. As long as The DAO does not make investments, the price of a DAO token can never exceed 1.0 ether. It would make no sense to pay more than 1.0 ether to receive 1.0 ether 48 days from now -- you'd just hold it yourself at no additional risk.

I watched in horror as a self-described "trader" was "reduced to tears" as he watched DAO token prices drop below 1.0. Yet this is precisely what any Econ 101 student could have predicted given the reasoning above. There is a probability curve of possible outcomes, and it is cut off sharply at 1.0. The only way the price of a DAO token can be 1.0 (assuming the DAO has not made any investments) is if there was absolutely no possibility whatsoever that ether would lose any value in 48 days.

It is irresponsible to pitch The DAO buying back its own tokens as "arbitrage." In finance, arbitrage opportunities refer to price differences between two equal instruments. Buying ether for delivery 48 days from now is most certainly not equal to holding ether now. There is significant exchange rate risk during those 48 days. So call a spade a spade and name this what it is: ether speculation.

This points out a fundamental problem with programmable financial assets: there are so many degrees of freedom that it's difficult to compare asset prices and perform arbitrage. In fact, I would not be surprised if the developers purposefully made their contracts complex to discourage such comparisons. Additional complexity also makes it difficult for the investors to figure out what exactly they are buying. Why should someone who wants to exit a crowd-funding vehicle follow a weird software engineering pattern that is tantamount to buying a timelocked asset? What exactly happens to the reward tokens of The DAO through splits? Why is this stuff so needlessly complicated?

In any case, The DAO blindly purchasing its own tokens based on a 6% appreciation denominated in ether has a simple name: currency speculation in ether.

The DAO was formed to make investments, to bring extra value into the world. Purchasing timelocked ether brings absolutely no value of any kind.

The masses love Ponzis until the music stops. Then all that remains are mugshots.

Should The DAO categorically stay away from financial speculation?

I believe it should: the risk is too great for the crowds to get caught up in complex feedback loops that give rise to Ponzis and pyramids. Perhaps these dynamics are inadvertant, but perhaps not: they may well be fanned by people who know better but don't let on.

Specifically, in this particular naturally-arising Ponzi scenario involving The DAO buying its own tokens, people buy ether and lock it up in The DAO in order to speculate in ether futures, which in turn fuels a price rise in ether (because there is less ether available to buy and supply drops), and corresponding paper gains. This will attract more people into instruments like The DAO, who have heard of these sure-fire gains in 48 days. As they lock up their ether, there will be even less ether to go around, giving rise to increases in the price of ether, which then fuels the next round of investments in The DAO, and so on.

The music will stop on any such investment the moment when investors want to cash out: the people who exit early will be rewarded, while the order books collapse on people who are late in getting out.

Of course, we have to have to consider the possibility that this is what The DAO investors were hoping for in the first place. Thay may be thinking "that's cool, we'll get in on this Ponzi early!" Let me remind them that we're not at Lake Wobegone: not everyone can be an "early beneficiary" in a Ponzi. In fact, it's not their entrance time but their exit time that will determine whether they make money in a Ponzi. And there will be at least as many losers as there are winners. The sob stories will be unbearable, as anyone who has seen the dogecoin sob stories can attest. This will then bring in regulation, it will hurt ether, and give a black eye to the nascent idea of executable financial instruments.

Overall, anyone who quotes interest rates denominated in a virtual currency like ether, without mentioning the exchange rate risk at exit time, is doing something unethical, and deeply flawed, in my book. Is it possible that all these traders-turned-social-media-manipulators are totally oblivious of these dynamics, caught up in short term "arbitrage opportunities"? I don't know, but I suspect that the world is not full of complete idiots who do not understand the investment vehicles they are playing with. I suspect it's much more likely that some people are riling up the crowds on purpose, feeding them just enough of the story to make the investment appealing, without disclosing the risks: in short, setting people up for a natural Ponzi.

And we know that crowds naturally flock to Ponzis. The masses actually love the idea of any kind of get-rich-quick scheme, and hate the regulators who interfere with them. We know this from the historical accounts from the 1930's: Charles Ponzi was a popular man, well-loved by his investors, who dreamed of striking it very rich. We have even seen Ponzis in our lifetimes: in the 1990's, almost everyone in Albania was invested up to his/her neck in some Ponzi or another. And they almost toppled their government for "interference" when their Ponzi dreams collapsed. For all they were concerned, math be damned, they were all headed to the moon, were it not for the pesky regulators who had to step in.

Let's not have a repeat of that in the ether currency space, and let's not give Decentralized Autonomous Organizations a bad name by turning the first successfully funded DAO into a Ponzi. The DAO buying back its own tokens is certainly a step in that direction, and I strongly encourage the community to stay away from funding such proposals [2].

To summarize, there are three distinct points here:

| [1] | Before some pedant points it out, the actual ratio is 100:1. Like all things involving The DAO, there is unnecessary complexity and randomly chosen constants thrown in everywhere. I use a 1:1 ratio to make the discussion easier to follow. Savvy DAOists should multiply or divide by 100 as appropriate. |

| [2] | A related question, of course, is what's the charter of The DAO and should the curators nix such meta-investment proposals for being outside the charter of The DAO in the first place? I'll leave that can of worms untouched for now, and let the curators sort it out. |

Many thanks to Andrew Miller, Phil Daian and Ittay Eyal for their feedback on an earlier draft of this post.