While the "who has power in Bitcoin?" discussion was taking place yesterday, Stephen Pair, CEO at BitPay, a large but beleaguered Bitcoin payment processor, posted something titled "Miners Control Bitcoin." That post opens up with the false premise that to "take" control out of miners' hands would necessarily lead to a centralized system, and gets better from there, with some muddled arguments about how miners control the coin entirely, but must compete to provide a "good service at a competitive price point."

First of all, if miners actually controlled Bitcoin, it'd be impossible to take control away from them by definition. Just the fact that his friends are suggesting the idea should have tipped him off that perhaps there is something wrong with the world view that miners control the blockchain.

Second, centralized control is not the diametrical opposite of, or the sole alternative to, being puppet-mastered by the miners. The miners already do not control Bitcoin, and we did not have a Central Planning Board or a Five Year Plan last I checked. The consumers (users and merchants alike) who wield power are themselves a decentralized bunch.

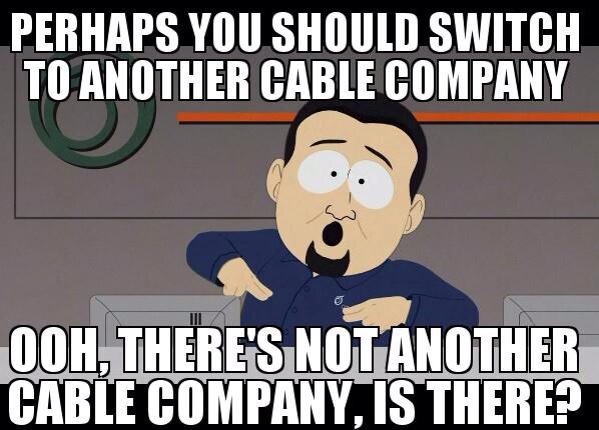

I won't go through the rest of the post in detail. The dead giveaway that something is fundamentally wrong is evident from the phrasing that miners have to compete to provide a "good service at a competitive price point." Think about the things over which you have control. What you cook for dinner. What doodles you draw on paper. Where you drive your car. Or think about the things over which someone else, whether singular or an ensemble, has full control. The speed of your Internet connection, if you live in the US. Whether or not you get pulled aside by TSA agents for additional screening. And so on. In none of these cases, do the people who are in control have to compete with anyone. By definition, they are in control. They determine the rules.

The miners have to compete for your wealth because they are not in control. They seek something that only the customers have -- your cash, and its concomitant ability to affect change in the real world -- in return for an intangible and highly replaceable commodity they produce that is trapped in the virtual realm, namely, digital blocks.

I won't go into further detail because my previous post already discussed the specifics. The customers do need to work with miners to deter attacks and the developers to maintain a healthy community, but they are far from weak, powerless players. I'm not sure what's up with CEOs in this space, and why they all exhibit learned helplessness, but we made some progress with the Coinbase CEO Bryan Armstrong yesterday. Come join our ranks! Bitcoin users aren't lemmings who will just adopt the longest datastructure just because it's long! There is nothing desirable about a long chain trapped in a machine in a world where anyone can make an alternative chain on her machine. Meanwhile, the real-world cash and goods that exchanges and payment processors bring into the ecosystem have tangible value. It can actually affect change and touch lives, something no datastructure can do. And that's why the users lead, and miners follow.

comments powered by Disqus